Cash flow is the lifeblood of your business! It is the measurement of the amount of cash that comes into and out of your business throughout a certain amount of time.

There are some simple ways to ensure you are keeping your cash flow moving:

1. Keep your books accurate and up to date

2. Make sure your customers pay you on time

3. Keep your business and personal finance separate

4. Work towards having a cash reserve – a pot of money you can dip into if you need too

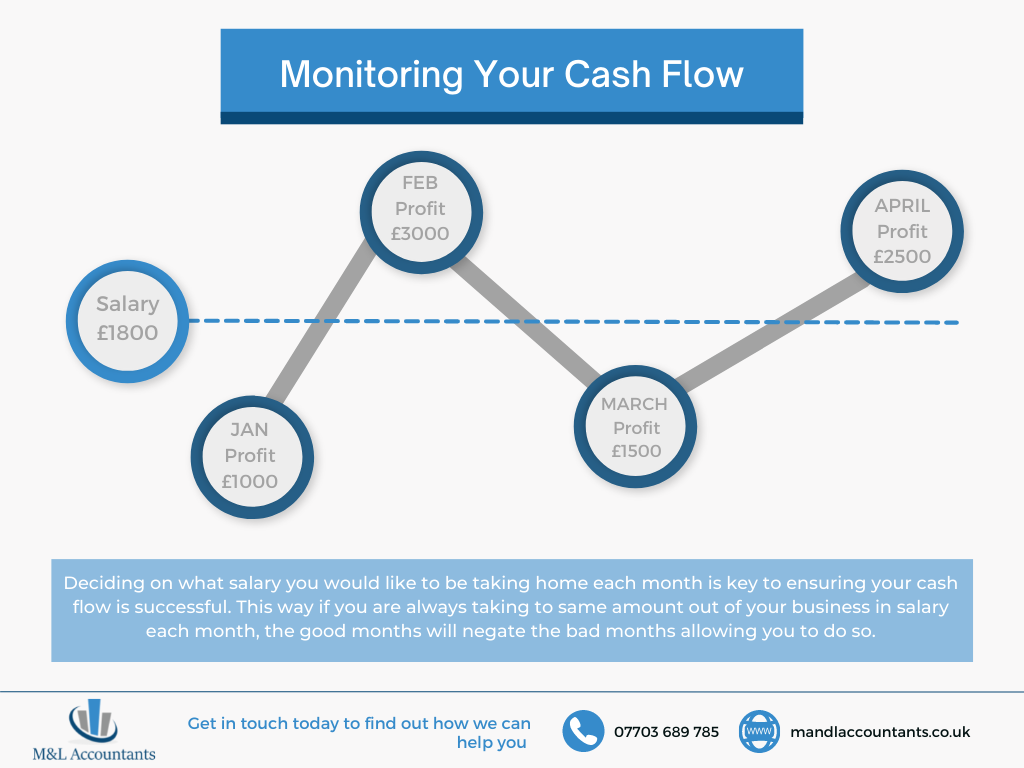

However, one of the biggest questions we receive from our clients is how to manage your cash flow alongside paying your wages. So we created this handy infographic to demonstrate how to ensure you are paying yourself the right amount in correlation to your profits.

First off we suggest you sit down and decide how much you want to take as a wage each month. Once you have this figure you then need to work out what this is made up of. How many clients/jobs do you need to take on minus the expenses and tax liabilities you’ll incur, to make up to this amount of money.

Once you have these figures you can then look at your monthly profit and wages on a more long term basis. Essentially, you should take the same salary each month regardless of whether you have a good or a bad profit month. As over a period of time your good months will negate the bad months. However, It is important that you monitor this each quarter to ensure that your good months are out weighing the bad, you can then adjust your salary accordingly at this point. This is where an accountant can come in handy, they can keep an eye on this for you.

Get in touch with us today to find out how we can help you.

We believe that a personal approach to client management is important and we ensure that we always go the extra mile to make sure that your accounts are up to date and comply with all regulations. With our expert knowledge we are happy to advise you on all finance related matters.